The FCA published the consultation paper CP22/2 in January 2022: Strengthening our financial promotion rules for high risk investments, including cryptoassets.

https://www.fca.org.uk/publication/consultation/cp22-2.pdf

ShareIn’s feedback was sent 23rd March 2022. The FCA have stated they intend to publish the Policy Statement and final Handbook rules in summer 2022.

ShareIn’s Feedback to the FCA on the Paper

ShareIn is broadly supportive of the objectives of these reforms which aim to maintain consistent standards across a range of investment products and balance the need to ensure customers understand the risks of their decisions as well as having access to investments which can play a positive role in their portfolio.

However, we do feel that careful consideration is needed to address concerns raised on specific details of the proposals which could undermine the good practices of the best of the sector in pursuit of protections against actions which are largely the result of bad actors or activities outside of the legitimate regulated industry. In particular we would highlight the proposal to introduce effectively a “double cooling off” as potentially counterproductive to the overall aims to strengthen the customer journey.

We would also highlight the importance which all legitimate industry players place on long term customer relationships and repeat investment from loyal (and satisfied) customers. The customer survey submitted by ShareIn and by the UK Crowdfunding Association (UKCFA), of which ShareIn is a founding member, as part of the Discussion Paper last year showed high levels of satisfaction amongst existing customers and the current reforms are mainly focused on customers who are wholly new to the industry or where offers are made by firms as a “one off”. We welcome the proposals to gather data on the effectiveness of these proposals and look forward to further constructive discussions via the UKCFA about the measures and hope that the FCA will listen to direct industry experience of working with customers to refine elements of the guidance over time.

We wholeheartedly support the proposal that SIS rules are not being extended and for reasons set out in paragraph 3.19 of the consultation, we strongly urge the FCA to carefully consider any future possible extension given the huge damage this could cause for both fundraising and providing access to investment opportunities. Having consulted and concluded that this was not appropriate at this time, it is unhelpful and destabilising to the market to then say this will be revisited later this year.

We would also emphasize our support for improving the wording of categorisation certificates, with the caveat that HM Treasury proposals will be consulted upon by the FCA, in particular in relation to the usefulness of defining sophisticated investors in terms of experience of investments in unlisted companies which is almost a defining aspect of the investment base.

Overview of proposed changes that impact ShareIn

Changes are proposed by the FCA in the following areas:

1. Classification of high-risk investments (see notes on Chapter 3 below);

2. Consumer journey into high-risk investments (see notes on Chapter 4 below);

3. Strengthening the role of firms approving and communicating financial promotions (see notes on Chapter 5 below); and

4. Applying financial promotions rules to qualifying cryptoassets (N/A for ShareIn and our appointed representatives (ARs)).

Classification of high-risk investments (Chapter 3 of CP):

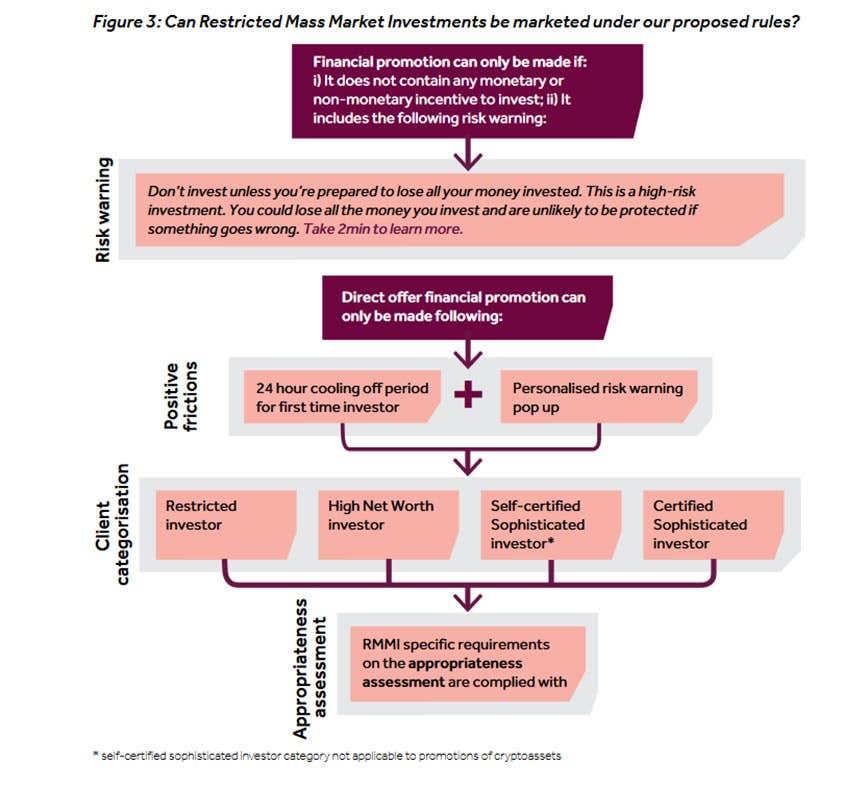

The CP seeks to rationalise the way that high-risk investments are currently categorised to ensure products with similar characteristics are treated in the same way under the financial promotions rules, by creating the following 2 categories:

1. Restricted Mass Market Investments (RMMI): The CP proposes that Non-Readily Realisable Securities (NRRS) and Peer-to-Peer (P2P) agreements should fall under the banner of ‘Restricted Mass Marketing Investments’. Per the current rules, these investments can be marketed to retail consumers, with certain restrictions. ShareIn’s ARs currently offer investments that fall under RMMI.

2. Non-Mass Market Investments (NMMI): The CP proposes that Non-Mainstream Pooled Investments (NMPI) and Speculative Illiquid Securities (SIS) should fall under the banner of ‘Non-Mass Market Investments’. Per the current rules, these investments are banned from being mass-marketed to retail investors. ShareIn’s ARs do not offer investments that fall under NMMI.

Potential extension of the SIS rules: Discussion Paper 21/1 discussed expanding the SIS rules to include equity shares and P2P agreements with similar characteristics to a SIS. Whilst the FCA are clear they do not want to allow opportunities for arbitrage (firms restructuring deals to avoid being caught by the SIS rules), they do not propose extending the SIS rules as part of this consultation, but plan to revisit this issue later in the year.

Strengthening the consumer journey for high-risk investments (Chapter 4):

The FCA is seeking to strengthen the consumer journey for RMMI and NMMI by (NB: more detail is provided on points a - e below):

a. improving risk warnings to help consumers better understand and engage with them;

b. banning inducements to invest (can lead to inappropriate investments / abused by bad actors) such as refer a friend;

c. add positive frictions to the consumer journey to counter social / emotional pressures and support more considered investment decisions;

d. making changes to investor declarations to improve investor categorisation; and

e. strengthening appropriateness tests to ensure a robust assessment of knowledge and experience (NB: RMMI only – i.e. this applies to ShareIn and its ARs).

a) Improving risk warnings:

The FCA proposes to require all financial promotions for RMMI and NMMI to contain the following risk warning in compliance with prescribed format requirements:

- “Don’t invest unless you’re prepared to lose all your money invested. This is a high-risk investment. You could lose all the money you invest and are unlikely to be protected if something goes wrong. Take 2min to learn more.”

‘Take 2min to learn more’ risk information: The proposal is to introduce prescribed risk information for different types of high-risk investment, presented in a pop-up box when a consumer clicks on the link in the risk warning. For financial promotions that are not on websites, mobile applications, or other digital mediums, the ‘Take 2min to learn more’ risk summary should be provided to the consumer in a durable medium where possible.

b) Banning inducements to invest:

Based on examples of bad actors using inducements to invest, e.g. refer a friend and new joiner bonuses, to achieve rapid and exponential growth in fraudulent investment schemes. Even when used by legitimate firms, the FCA is still concerned that these inducements unduly influence consumers’ investment decisions and can cause them to invest in something that is not right for them.

The FCA intends to ban financial promotions for high-risk investments from containing any monetary or non-monetary benefits that incentivise investment activity. The FCA welcomes Consultation feedback on whether certain items should be excluded from the ban to avoid negative unintended consequences.

c) Positive frictions:

The FCA proposes to introduce 2 positive frictions:

1. Personalised risk warning pop-up for first time investors with a firm: For RMMI, this would appear before a Direct Offer Financial Promotion could be communicated (before communication of a financial promotion for NMMI).

- Proposed wording: “[Client name], this is a high-risk investment. How would you feel if you lost the money you’re about to invest? Take 2min to learn more.”

- The ‘Take 2min to learn more’ would link to the product-specific risk summaries noted above.

2. 24-hour cooling off period for first time investors with a firm: This would apply after the personalised risk warning pop-up and means that the consumer cannot receive the Direct Offer Financial Promotion (RMMI) or financial promotion (NMMI) unless they re-confirm their request to proceed after waiting at least 24 hours.

d) Helping clients better categorise themselves:

On client categorisation, the FCA propose to:

- Implement an evidence declaration where consumers will be required to state why they meet the relevant criteria (e.g. stating their income to demonstrate they are HNW).

- Simplify the language used in the declaration and add a ‘none of the above’ option to the declarations.

e) Appropriateness tests:

The FCA has set out several proposals related to the appropriateness test:

- Introduce guidance on the types of questions for app tests for RMMI, similar to the P2P guidance. This will not be a complete / prescriptive list; robust and effective assessments considering the features and risks of the investments is required by firms.

- Extend existing P2P guidance discouraging binary yes/no answers to all RMMI, with the guidance being broadened to suggest firms avoid any kind of binary choice.

- Amend rules to ensure that an investment must always be determined as appropriate for a consumer before an order or application for the RMMI is fulfilled in response to a Direct Offer financial promotion. (NB: ShareIn already do this.)

- Introduce a rule that where an investor fails the appropriateness test, they cannot retake the test for at least 24 hours (firms should consider whether more time is appropriate based on complexity and level of inherent risk of the product).

- Introduce a rule that the questions asked must be different each time a consumer takes the test. Consumers should only be told the broad areas that caused them to fail the test rather than specific questions (to avoid ‘coaching’). The different questions should be sufficiently differentiated so that answers to questions on a subsequent test cannot simply be read across from the previous questions. (Aims to encourage consumers to do further research to educate themselves rather than use trial and error.)

- Firms should not be able to give the consumer information about answers / feedback from the point the test starts until it is completed. (Firms can still give consumers educational material outside the app test.)

- Introduce guidance to say that firms should not, in their communications with consumers, encourage them to retake the test after they’ve failed it if they have not attempted to do so on their own initiative. (This would not stop firms informing consumers of the outcomes of the app test, the option to retake it, or educational content about the investment.)

Strengthening the role of authorised firms communicating and approving financial promotions (Chapter 5)

The FCA propose changes to 3 key areas of the financial promotion lifecycle (these are described in more detail below):

- Approving and communicating promotions – including a new date stamp for approved promotions and new competence and expertise requirement for firms communicating / approving financial promotions.

- Lifetime of the promotion – including ongoing monitoring requirement for firms approving promotions.

- Consumer journey – clarifying the role of firms approving promotions in client categorisation and app test for RMMI.

Approving promotions:

Per the existing rules (COBS 4.5.2R), a financial promotion to a retail client must include the name of the firm that approved it. The FCA now proposes that section 21 (s21) approvers must ensure the financial promotion clearly states on the face the date on which it was approved.

Lifetime of the promotion:

To have effective ongoing monitoring, the s21 approver will need to consider whether:

- There have been any changes to the promotion, which mean it is no longer being lawfully communicated.

- There have been any changes which may affect whether the promotion continues to be fair, clear, and not misleading (including ongoing commercial viability of the proposition, and assessing whether headline rates of return continue to be reasonably achievable).

- Funds raised are being used for the purposes described in the promotion.

- The promotion complies with any new requirements introduced by the FCA, e.g. risk disclosures / positive frictions (per Chapter 4 of the CP).

Attestations of ‘no material change’: The FCA proposes that s21 approvers collect attestations of ‘no material change’ from clients with approved promotions every 3 months over the lifetime of the promotion. If the client does not respond or the approver is unable to get an attestation, they should consider withdrawing approval.

Consumer journey:

NB: These proposals deal with the oversight by the s21 approver of the appropriateness test – ShareIn already has oversight of the app test for all AR platforms for whom we provide s21 approvals.