Cash ISA

If you’re a Bank yourself or offer Savings products contact us to discuss a Cash ISA offering. Bundle various savings products into your bespoke flexible Cash ISA.

Stocks and Shares ISA

If you’re offering listed investments to UK retail investors and would like to find out more about your own S&S ISA wrapper contact us.

Innovative Finance ISA (IF ISA)

If you’re a P2P platform or offering unlisted bonds and aren’t currently offering an IF ISA contact us. We’ve been holding client money since 2019.

ISA API only

Integrate into your technology stack with our guidance. Our ISA API is a service to record users ISA related transactional activity throughout the tax year and can be used to police ISA thresholds. The API is complemented with an administrative console for managing ISA transfers in and ISA transfers out. The console makes HMRC ISA activity report available at the year end so you can easily fulfil your reporting obligations.

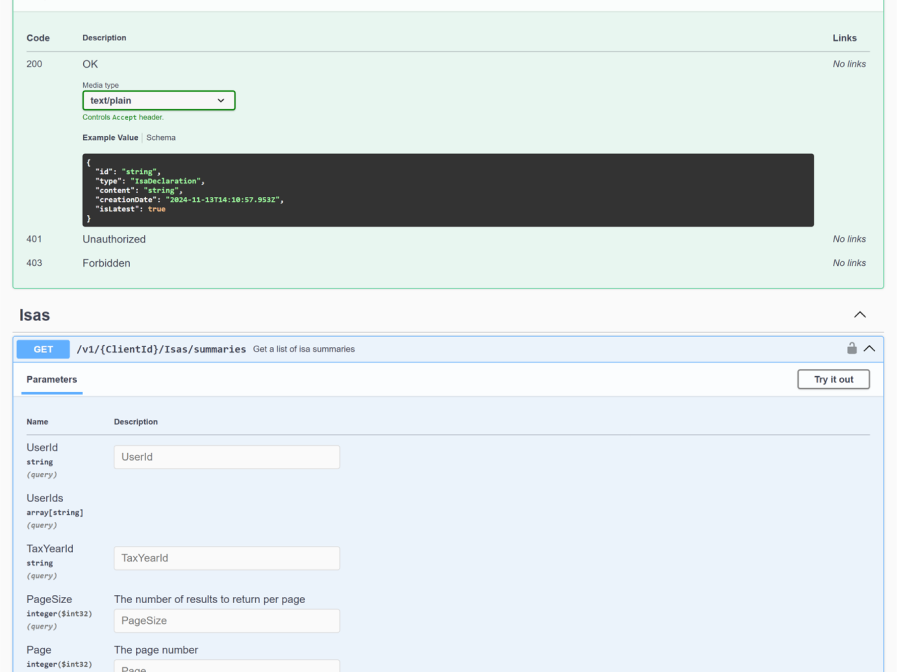

ISA API endpoint details

ISA portal

If you don’t have the development bandwidth to integrate our API we can build a fully branded ISA portal.

Cash in your infrastructure or ours

If you’d prefer cash to stay within your existing savings infrastructure we work with you to accommodate that.

KYC

We work with you to optimise KYC, fulfilling everyone’s obligations without sacrificing customer experience.

ISA Admin

We can be the ISA Manager ourselves; we have been for years or if you are an ISA Manager you can delegate your administrative functions to us. Keeping up to date with all the latest ISA regulations, handling your Transfers In and Out and all your record keeping and HMRC reporting.

Ready to offer ISAs on your platform?

Talk to our team about ISA management for your investment platform.

Discuss your ISA needsEnsure Compliant Reporting

We track ISA activity across your platform providing you with HMRC ready ISA reports. If you have your own platform compliant reporting is possible using our ISA API service.

ISA API ServiceLet's build your investment channel

Find out how our platform can power your next investment product.

Get started